Page 345 - MSM_AIR2021

P. 345

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 343

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

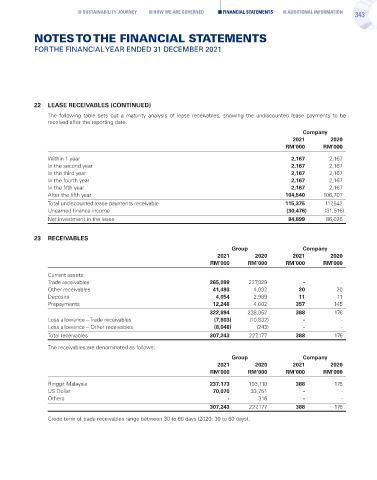

22 LEASE RECEIVABLES (CONTINUED)

The following table sets out a maturity analysis of lease receivables, showing the undiscounted lease payments to be

received after the reporting date.

Company

2021 2020

RM’000 RM’000

Within 1 year 2,167 2,167

In the second year 2,167 2,167

In the third year 2,167 2,167

In the fourth year 2,167 2,167

In the fifth year 2,167 2,167

After the fifth year 104,540 106,707

Total undiscounted lease payments receivable 115,375 117,542

Unearned finance income (30,476) (31,516)

Net investment in the lease 84,899 86,026

23 RECEIVABLES

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Current assets:

Trade receivables 265,099 227,029 - -

Other receivables 41,493 4,032 20 20

Deposits 4,054 2,989 11 11

Prepayments 12,248 4,002 357 145

322,894 238,052 388 176

Loss allowance – Trade receivables (7,603) (10,632) - -

Loss allowance – Other receivables (8,048) (243) - -

Total receivables 307,243 227,177 388 176

The receivables are denominated as follows:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Ringgit Malaysia 237,173 193,110 388 176

US Dollar 70,070 33,751 - -

Others - 316 - -

307,243 227,177 388 176

Credit term of trade receivables range between 30 to 60 days (2020: 30 to 60 days).