Page 340 - MSM_AIR2021

P. 340

338 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

19 INTANGIBLE ASSETS (CONTINUED)

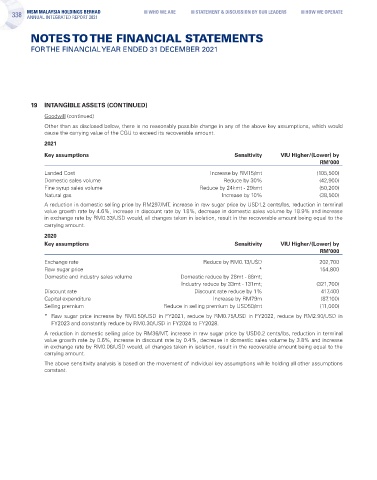

Goodwill (continued)

Other than as disclosed below, there is no reasonably possible change in any of the above key assumptions, which would

cause the carrying value of the CGU to exceed its recoverable amount.

2021

Key assumptions Sensitivity VIU Higher/(Lower) by

RM’000

Landed Cost Increase by RM15/mt (105,500)

Domestic sales volume Reduce by 30% (42,900)

Fine syrup sales volume Reduce by 24kmt - 29kmt (50,200)

Natural gas Increase by 10% (38,500)

A reduction in domestic selling price by RM297/MT, increase in raw sugar price by USD1.2 cents/lbs, reduction in terminal

value growth rate by 4.6%, increase in discount rate by 1.8%, decrease in domestic sales volume by 18.9% and increase

in exchange rate by RM0.33/USD would, all changes taken in isolation, result in the recoverable amount being equal to the

carrying amount.

2020

Key assumptions Sensitivity VIU Higher/(Lower) by

RM’000

Exchange rate Reduce by RM0.13/USD 202,700

Raw sugar price * 154,800

Domestic and industry sales volume Domestic reduce by 28mt - 88mt;

Industry reduce by 33mt - 131mt; (321,700)

Discount rate Discount rate reduce by 1% 417,400

Capital expenditure Increase by RM79m (87,100)

Selling premium Reduce in selling premium by USD50/mt (11,000)

* Raw sugar price increase by RM0.50/USD in FY2021, reduce by RM0.75/USD in FY2022, reduce by RM2.90/USD in

FY2023 and constantly reduce by RM0.30/USD in FY2024 to FY2028.

A reduction in domestic selling price by RM36/MT, increase in raw sugar price by USD0.2 cents/lbs, reduction in terminal

value growth rate by 0.6%, increase in discount rate by 0.4%, decrease in domestic sales volume by 3.8% and increase

in exchange rate by RM0.06/USD would, all changes taken in isolation, result in the recoverable amount being equal to the

carrying amount.

The above sensitivity analysis is based on the movement of individual key assumptions while holding all other assumptions

constant.