Page 344 - MSM_AIR2021

P. 344

342 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

21 LOANS DUE FROM SUBSIDIARIES (CONTINUED)

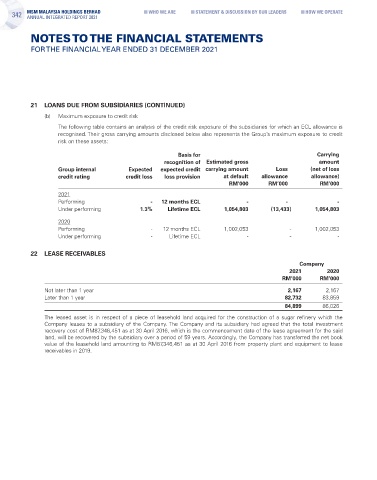

(b) Maximum exposure to credit risk

The following table contains an analysis of the credit risk exposure of the subsidiaries for which an ECL allowance is

recognised. Their gross carrying amounts disclosed below also represents the Group’s maximum exposure to credit

risk on these assets:

Basis for Carrying

recognition of Estimated gross amount

Group internal Expected expected credit carrying amount Loss (net of loss

credit rating credit loss loss provision at default allowance allowance)

RM’000 RM’000 RM’000

2021

Performing - 12 months ECL - - -

Under performing 1.3% Lifetime ECL 1,054,803 (13,433) 1,054,803

2020

Performing - 12 months ECL 1,002,053 - 1,002,053

Under performing - Lifetime ECL - - -

22 LEASE RECEIVABLES

Company

2021 2020

RM’000 RM’000

Not later than 1 year 2,167 2,167

Later than 1 year 82,732 83,859

84,899 86,026

The leased asset is in respect of a piece of leasehold land acquired for the construction of a sugar refinery which the

Company leases to a subsidiary of the Company. The Company and its subsidiary had agreed that the total investment

recovery cost of RM87,346,451 as at 30 April 2016, which is the commencement date of the lease agreement for the said

land, will be recovered by the subsidiary over a period of 59 years. Accordingly, the Company has transferred the net book

value of the leasehold land amounting to RM87,346,451 as at 30 April 2016 from property plant and equipment to lease

receivables in 2019.