Page 348 - MSM_AIR2021

P. 348

346 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

23 RECEIVABLES (CONTINUED)

(b) Reconciliation of loss allowance (continued)

(i) Trade receivables using simplified approach (continued)

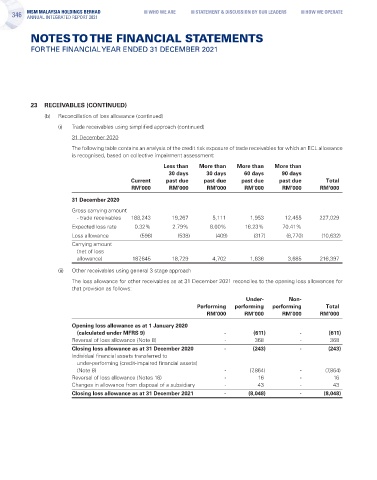

31 December 2020

The following table contains an analysis of the credit risk exposure of trade receivables for which an ECL allowance

is recognised, based on collective impairment assessment:

Less than More than More than More than

30 days 30 days 60 days 90 days

Current past due past due past due past due Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

31 December 2020

Gross carrying amount

- trade receivables 188,243 19,267 5,111 1,953 12,455 227,029

Expected loss rate 0.32% 2.79% 8.00% 16.23% 70.41%

Loss allowance (598) (538) (409) (317) (8,770) (10,632)

Carrying amount

(net of loss

allowance) 187,645 18,729 4,702 1,636 3,685 216,397

(ii) Other receivables using general 3 stage approach

The loss allowance for other receivables as at 31 December 2021 reconciles to the opening loss allowances for

that provision as follows:

Under- Non-

Performing performing performing Total

RM’000 RM’000 RM’000 RM’000

Opening loss allowance as at 1 January 2020

(calculated under MFRS 9) - (611) - (611)

Reversal of loss allowance (Note 8) - 368 - 368

Closing loss allowance as at 31 December 2020 - (243) - (243)

Individual financial assets transferred to

under-performing (credit-impaired financial assets)

(Note 8) - (7,864) - (7,864)

Reversal of loss allowance (Notes 16) - 16 - 16

Changes in allowance from disposal of a subsidiary - 43 - 43

Closing loss allowance as at 31 December 2021 - (8,048) - (8,048)