Page 342 - MSM_AIR2021

P. 342

340 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

20 INVESTMENTS IN SUBSIDIARIES (CONTINUED)

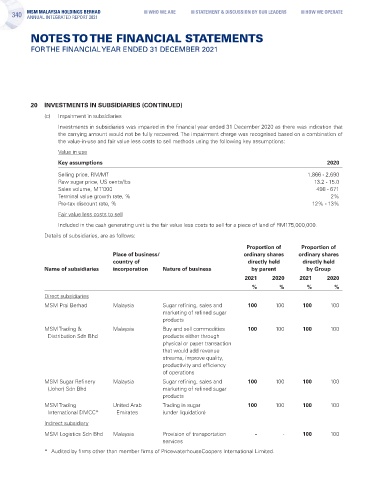

(c) Impairment in subsidiaries

Investments in subsidiaries was impaired in the financial year ended 31 December 2020 as there was indication that

the carrying amount would not be fully recovered. The impairment charge was recognised based on a combination of

the value-in-use and fair value less costs to sell methods using the following key assumptions:

Value in use

Key assumptions 2020

Selling price, RM/MT 1,866 - 2,690

Raw sugar price, US cents/lbs 13.2 - 15.0

Sales volume, MT’000 498 - 671

Terminal value growth rate, % 2%

Pre-tax discount rate, % 12% - 13%

Fair value less costs to sell

Included in the cash generating unit is the fair value less costs to sell for a piece of land of RM175,000,000.

Details of subsidiaries, are as follows:

Proportion of Proportion of

Place of business/ ordinary shares ordinary shares

country of directly held directly held

Name of subsidiaries incorporation Nature of business by parent by Group

2021 2020 2021 2020

% % % %

Direct subsidiaries

MSM Prai Berhad Malaysia Sugar refining, sales and 100 100 100 100

marketing of refined sugar

products

MSM Trading & Malaysia Buy and sell commodities 100 100 100 100

Distribution Sdn Bhd products either through

physical or paper transaction

that would add revenue

streams, improve quality,

productivity and efficiency

of operations

MSM Sugar Refinery Malaysia Sugar refining, sales and 100 100 100 100

(Johor) Sdn Bhd marketing of refined sugar

products

MSM Trading United Arab Trading in sugar 100 100 100 100

International DMCC* Emirates (under liquidation)

Indirect subsidiary

MSM Logistics Sdn Bhd Malaysia Provision of transportation - - 100 100

services

* Audited by firms other than member firms of PricewaterhouseCoopers International Limited.