Page 347 - MSM_AIR2021

P. 347

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 345

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

23 RECEIVABLES (CONTINUED)

(b) Reconciliation of loss allowance (continued)

(i) Trade receivables using simplified approach (continued)

31 December 2021

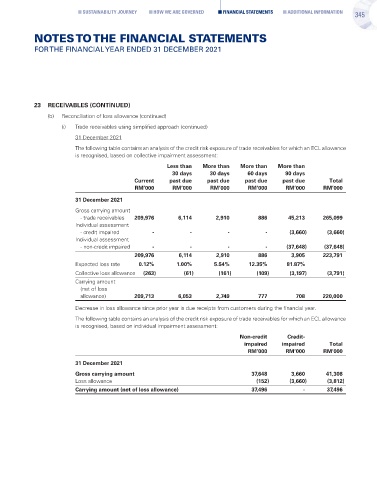

The following table contains an analysis of the credit risk exposure of trade receivables for which an ECL allowance

is recognised, based on collective impairment assessment:

Less than More than More than More than

30 days 30 days 60 days 90 days

Current past due past due past due past due Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

31 December 2021

Gross carrying amount

- trade receivables 209,976 6,114 2,910 886 45,213 265,099

Individual assessment

- credit impaired - - - - (3,660) (3,660)

Individual assessment

- non-credit impaired - - - - (37,648) (37,648)

209,976 6,114 2,910 886 3,905 223,791

Expected loss rate 0.12% 1.00% 5.54% 12.35% 81.87%

Collective loss allowance (263) (61) (161) (109) (3,197) (3,791)

Carrying amount

(net of loss

allowance) 209,713 6,053 2,749 777 708 220,000

Decrease in loss allowance since prior year is due receipts from customers during the financial year.

The following table contains an analysis of the credit risk exposure of trade receivables for which an ECL allowance

is recognised, based on individual impairment assessment:

Non-credit Credit-

impaired impaired Total

RM’000 RM’000 RM’000

31 December 2021

Gross carrying amount 37,648 3,660 41,308

Loss allowance (152) (3,660) (3,812)

Carrying amount (net of loss allowance) 37,496 - 37,496