Page 346 - MSM_AIR2021

P. 346

344 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

23 RECEIVABLES (CONTINUED)

(a) Included in other receivables are cash placed for sugar futures trading facilities of RM17,970,000 (2020: RM Nil).

(b) Reconciliation of loss allowance

(i) Trade receivables using simplified approach

The Group and the Company applies MFRS 9 simplified approach to measuring expected credit losses which uses

a lifetime expected loss allowance for trade receivables.

To measure the expected credit losses, trade receivables have been grouped based on shared credit risk

characteristics and the days past due.

The expected loss rates are based on the payment profiles of revenue earned over a period of 24 months

before 31 December 2021 or 31 December 2020 respectively and the corresponding historical credit losses

experienced within this period. The historical loss rates were not adjusted to reflect forward-looking information

on macroeconomic factors affecting the ability of the customers to settle the receivables, as the Group has not

identified any forward looking assumptions which correlate to the historical loss rates.

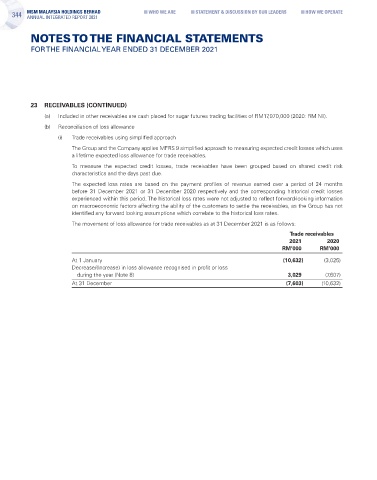

The movement of loss allowance for trade receivables as at 31 December 2021 is as follows:

Trade receivables

2021 2020

RM’000 RM’000

At 1 January (10,632) (3,025)

Decrease/(Increase) in loss allowance recognised in profit or loss

during the year (Note 8) 3,029 (7,607)

At 31 December (7,603) (10,632)