Page 341 - MSM_AIR2021

P. 341

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 339

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

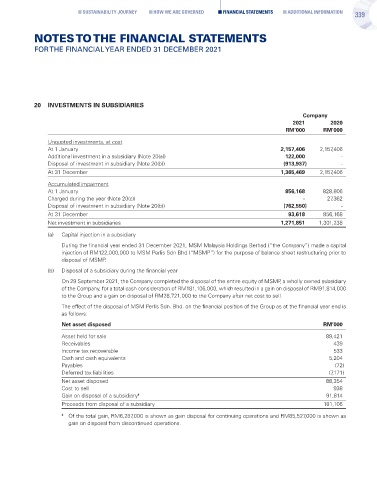

20 INVESTMENTS IN SUBSIDIARIES

Company

2021 2020

RM’000 RM’000

Unquoted investments, at cost

At 1 January 2,157,406 2,157,406

Additional investment in a subsidiary (Note 20(a)) 122,000 -

Disposal of investment in subsidiary (Note 20(b)) (913,937) -

At 31 December 1,365,469 2,157,406

Accumulated impairment

At 1 January 856,168 828,806

Charged during the year (Note 20(c)) - 27,362

Disposal of investment in subsidiary (Note 20(b)) (762,550) -

At 31 December 93,618 856,168

Net investment in subsidiaries 1,271,851 1,301,238

(a) Capital injection in a subsidiary

During the financial year ended 31 December 2021, MSM Malaysia Holdings Berhad (“the Company”) made a capital

injection of RM122,000,000 to MSM Perlis Sdn Bhd (“MSMP”) for the purpose of balance sheet restructuring prior to

disposal of MSMP.

(b) Disposal of a subsidiary during the financial year

On 29 September 2021, the Company completed the disposal of the entire equity of MSMP, a wholly owned subsidiary

of the Company, for a total cash consideration of RM181,106,000, which resulted in a gain on disposal of RM91,814,000

to the Group and a gain on disposal of RM28,721,000 to the Company after net cost to sell.

The effect of the disposal of MSM Perlis Sdn. Bhd. on the financial position of the Group as at the financial year end is

as follows:

Net asset disposed RM’000

Asset held for sale 89,421

Receivables 439

Income tax recoverable 533

Cash and cash equivalents 5,204

Payables (72)

Deferred tax liabilities (7,171)

Net asset disposed 88,354

Cost to sell 938

Gain on disposal of a subsidiary # 91,814

Proceeds from disposal of a subsidiary 181,106

# Of the total gain, RM6,287,000 is shown as gain disposal for continuing operations and RM85,527,000 is shown as

gain on disposal from discontinued operations.