Page 343 - MSM_AIR2021

P. 343

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 341

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

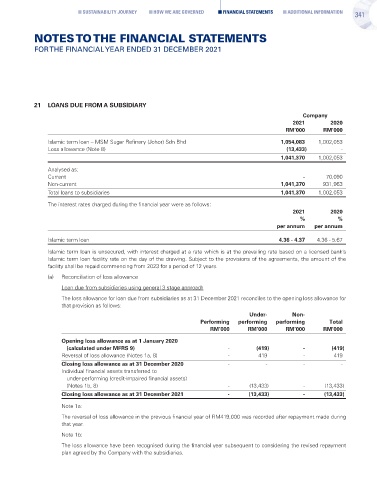

21 LOANS DUE FROM A SUBSIDIARY

Company

2021 2020

RM’000 RM’000

Islamic term loan – MSM Sugar Refinery (Johor) Sdn Bhd 1,054,083 1,002,053

Loss allowance (Note 8) (13,433) -

1,041,370 1,002,053

Analysed as:

Current - 70,090

Non-current 1,041,370 931,963

Total loans to subsidiaries 1,041,370 1,002,053

The interest rates charged during the financial year were as follows:

2021 2020

% %

per annum per annum

Islamic term loan 4.36 - 4.37 4.36 - 5.67

Islamic term loan is unsecured, with interest charged at a rate which is at the prevailing rate based on a licensed bank’s

Islamic term loan facility rate on the day of the drawing. Subject to the provisions of the agreements, the amount of the

facility shall be repaid commencing from 2023 for a period of 12 years.

(a) Reconciliation of loss allowance

Loan due from subsidiaries using general 3 stage approach

The loss allowance for loan due from subsidiaries as at 31 December 2021 reconciles to the opening loss allowance for

that provision as follows:

Under- Non-

Performing performing performing Total

RM’000 RM’000 RM’000 RM’000

Opening loss allowance as at 1 January 2020

(calculated under MFRS 9) - (419) - (419)

Reversal of loss allowance (Notes 1a, 8) - 419 - 419

Closing loss allowance as at 31 December 2020 - - - -

Individual financial assets transferred to

under-performing (credit-impaired financial assets)

(Notes 1b, 8) - (13,433) - (13,433)

Closing loss allowance as at 31 December 2021 - (13,433) - (13,433)

Note 1a:

The reversal of loss allowance in the previous financial year of RM419,000 was recorded after repayment made during

that year.

Note 1b:

The loss allowance have been recognised during the financial year subsequent to considering the revised repayment

plan agreed by the Company with the subsidiaries.