Page 353 - MSM_AIR2021

P. 353

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 351

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

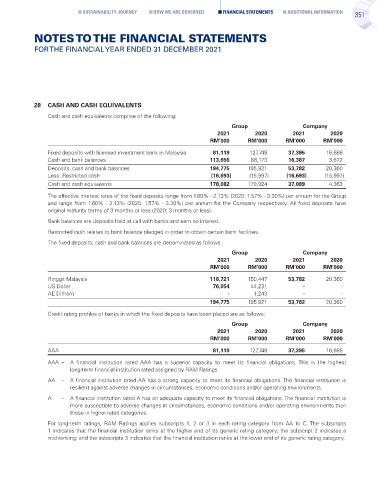

28 CASH AND CASH EQUIVALENTS

Cash and cash equivalents comprise of the following:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Fixed deposits with licensed investment bank in Malaysia 81,119 127,748 37,395 16,688

Cash and bank balances 113,656 68,173 16,387 3,672

Deposits, cash and bank balances 194,775 195,921 53,782 20,360

Less: Restricted cash (16,693) (15,997) (16,693) (15,997)

Cash and cash equivalents 178,082 179,924 37,089 4,363

The effective interest rates of the fixed deposits range from 1.60% - 2.13% (2020: 1.57% - 3.30%) per annum for the Group

and range from 1.60% - 2.13% (2020: 1.57% - 3.30%) per annum for the Company respectively. All fixed deposits have

original maturity terms of 3 months or less (2020: 3 months or less).

Bank balances are deposits held at call with banks and earn no interest.

Restricted cash relates to bank balance pledged in order to obtain certain bank facilities.

The fixed deposits, cash and bank balances are denominated as follows:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Ringgit Malaysia 118,721 150,447 53,782 20,360

US Dollar 76,054 44,231 - -

AE Dirham - 1,243 - -

194,775 195,921 53,782 20,360

Credit rating profiles of banks in which the fixed deposits have been placed are as follows:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

AAA 81,119 127,748 37,395 16,688

AAA – A financial institution rated AAA has a superior capacity to meet its financial obligations. This is the highest

long-term financial institution rated assigned by RAM Ratings.

AA – A financial institution rated AA has a strong capacity to meet its financial obligations. The financial institution is

resilient against adverse changes in circumstances, economic conditions and/or operating environments.

A – A financial institution rated A has an adequate capacity to meet its financial obligations. The financial institution is

more susceptible to adverse changes in circumstances, economic conditions and/or operating environments than

those in higher-rated categories.

For long-term ratings, RAM Ratings applies subscripts 1, 2 or 3 in each rating category from AA to C. The subscripts

1 indicates that the financial institution ranks at the higher end of its generic rating category; the subscript 2 indicates a

mid-ranking; and the subscripts 3 indicates that the financial institution ranks at the lower end of its generic rating category.