Page 322 - MSM_AIR2021

P. 322

320 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

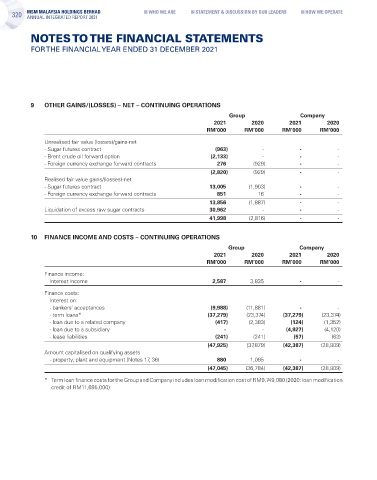

9 OTHER GAINS/(LOSSES) – NET – CONTINUING OPERATIONS

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Unrealised fair value (losses)/gains-net

- Sugar futures contract (963) - - -

- Brent crude oil forward option (2,133) - - -

- Foreign currency exchange forward contracts 276 (929) - -

(2,820) (929) - -

Realised fair value gains/(losses)-net

- Sugar futures contract 13,005 (1,903) - -

- Foreign currency exchange forward contracts 851 16 - -

13,856 (1,887) - -

Liquidation of excess raw sugar contracts 30,962 - - -

41,998 (2,816) - -

10 FINANCE INCOME AND COSTS – CONTINUING OPERATIONS

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Finance income:

Interest income 2,587 3,835 - -

Finance costs:

Interest on:

- bankers’ acceptances (9,988) (11,881) - -

- term loans* (37,279) (23,374) (37,279) (23,374)

- loan due to a related company (417) (2,383) (124) (1,352)

- loan due to a subsidiary - - (4,927) (4,120)

- lease liabilities (241) (241) (57) (63)

(47,925) (37,879) (42,387) (28,909)

Amount capitalised on qualifying assets

- property, plant and equipment (Notes 17, 36) 880 1,095 - -

(47,045) (36,784) (42,387) (28,909)

* Term loan finance costs for the Group and Company includes loan modification cost of RM9,749,080 (2020: loan modification

credit of RM11,695,000).