Page 326 - MSM_AIR2021

P. 326

324 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

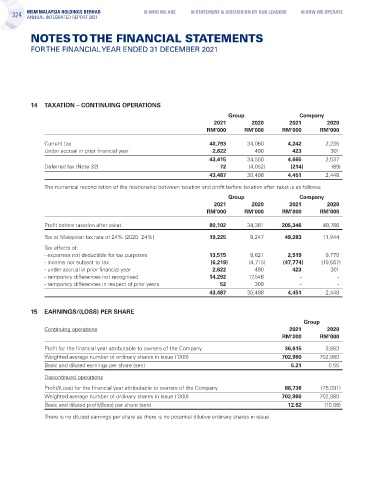

14 TAXATION – CONTINUING OPERATIONS

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Current tax 40,793 34,060 4,242 2,236

Under accrual in prior financial year 2,622 490 423 301

43,415 34,550 4,665 2,537

Deferred tax (Note 32) 72 (4,052) (214) (89)

43,487 30,498 4,451 2,448

The numerical reconciliation of the relationship between taxation and profit before taxation after zakat is as follows:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Profit before taxation after zakat 80,102 34,361 205,346 49,766

Tax at Malaysian tax rate of 24% (2020: 24%) 19,225 8,247 49,283 11,944

Tax effects of:

- expenses not deductible for tax purposes 13,515 8,621 2,519 9,770

- income not subject to tax (6,219) (4,715) (47,774) (19,567)

- under accrual in prior financial year 2,622 490 423 301

- temporary differences not recognised 14,292 17,546 - -

- temporary differences in respect of prior years 52 309 - -

43,487 30,498 4,451 2,448

15 EARNINGS/(LOSS) PER SHARE

Group

Continuing operations 2021 2020

RM’000 RM’000

Profit for the financial year attributable to owners of the Company 36,615 3,863

Weighted average number of ordinary shares in issue (‘000) 702,980 702,980

Basic and diluted earnings per share (sen) 5.21 0.55

Discontinued operations

Profit/(Loss) for the financial year attributable to owners of the Company 88,738 (75,091)

Weighted average number of ordinary shares in issue (‘000) 702,980 702,980

Basic and diluted profit/(loss) per share (sen) 12.62 (10.68)

There is no diluted earnings per share as there is no potential dilutive ordinary shares in issue.