Page 317 - MSM_AIR2021

P. 317

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 315

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

4 FINANCIAL RISK MANAGEMENT (CONTINUED)

(b) Capital risk management policies

The Group’s and Company’s primary objectives on capital management policies are to safeguard the Group’s and

Company’s ability to maintain healthy capital ratios to continue as a going concern in order to provide returns for

shareholders and benefits for other stakeholders and to maintain an optimal capital structure to reduce the cost

of capital.

The Group and Company manage its capital structure and make adjustments to it, in light of changes in economic

conditions. To maintain or adjust the capital structure, the Group and Company may adjust the dividend payment to

shareholders, return capital to shareholders or issue new shares. No changes were made in the objectives, policies or

processes during the financial year ended 31 December 2021 and 31 December 2020.

The Group considers its debts and equity attributable to owners of the Company as capital and monitor capital using

gearing ratio. This ratio is calculated as net debt divided by total capital of the Group and Company. Net debt is calculated

as total borrowings (including ‘current and non-current borrowings’ as shown in the consolidated statement of financial

position), lease liabilities and loan due to a related company less deposits, cash and bank balances. At Company level,

net debt also includes loan due to a subsidiary. Total capital is calculated as ‘equity attributable to owners of the Company

as shown in the consolidated statement of financial position plus the net debt of the Group and Company.

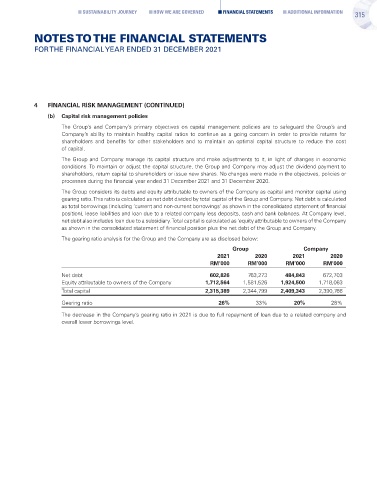

The gearing ratio analysis for the Group and the Company are as disclosed below:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Net debt 602,826 763,273 484,843 672,703

Equity attributable to owners of the Company 1,712,564 1,581,526 1,924,500 1,718,063

Total capital 2,315,389 2,344,799 2,409,343 2,390,766

Gearing ratio 26% 33% 20% 28%

The decrease in the Company’s gearing ratio in 2021 is due to full repayment of loan due to a related company and

overall lower borrowings level.