Page 318 - MSM_AIR2021

P. 318

316 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

4 FINANCIAL RISK MANAGEMENT (CONTINUED)

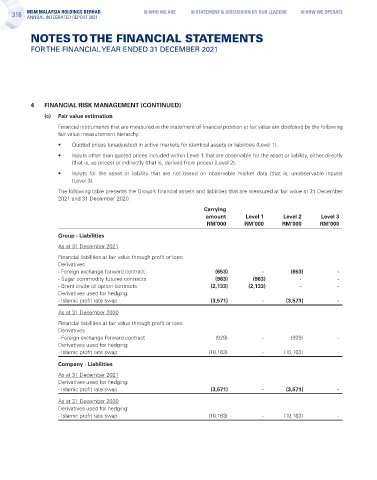

(c) Fair value estimation

Financial instruments that are measured in the statement of financial position at fair value are disclosed by the following

fair value measurement hierarchy:

• Quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1).

• Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly

(that is, as prices) or indirectly (that is, derived from prices) (Level 2).

• Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs)

(Level 3).

The following table presents the Group’s financial assets and liabilities that are measured at fair value at 31 December

2021 and 31 December 2020:

Carrying

amount Level 1 Level 2 Level 3

RM’000 RM’000 RM’000 RM’000

Group - Liabilities

As at 31 December 2021

Financial liabilities at fair value through profit or loss:

Derivatives

- Foreign exchange forward contract (653) - (653) -

- Sugar commodity futures contracts (963) (963) - -

- Brent crude oil option contracts (2,133) (2,133) - -

Derivatives used for hedging:

- Islamic profit rate swap (3,571) - (3,571) -

As at 31 December 2020

Financial liabilities at fair value through profit or loss:

Derivatives

- Foreign exchange forward contract (929) - (929) -

Derivatives used for hedging:

- Islamic profit rate swap (10,163) - (10,163) -

Company - Liabilities

As at 31 December 2021

Derivatives used for hedging:

- Islamic profit rate swap (3,571) - (3,571) -

As at 31 December 2020

Derivatives used for hedging:

- Islamic profit rate swap (10,163) - (10,163) -