Page 327 - MSM_AIR2021

P. 327

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 325

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

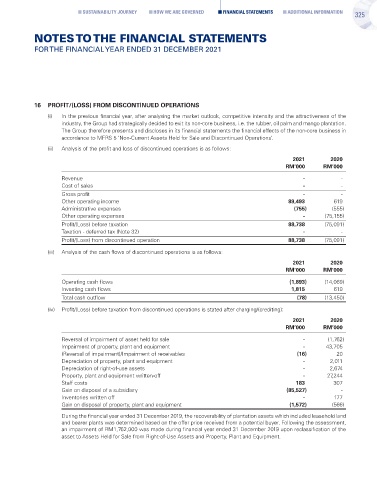

16 PROFIT/(LOSS) FROM DISCONTINUED OPERATIONS

(i) In the previous financial year, after analysing the market outlook, competitive intensity and the attractiveness of the

industry, the Group had strategically decided to exit its non-core business, i.e. the rubber, oil palm and mango plantation.

The Group therefore presents and discloses in its financial statements the financial effects of the non-core business in

accordance to MFRS 5 ‘Non-Current Assets Held for Sale and Discontinued Operations’.

(ii) Analysis of the profit and loss of discontinued operations is as follows:

2021 2020

RM’000 RM’000

Revenue - -

Cost of sales - -

Gross profit - -

Other operating income 89,493 619

Administrative expenses (755) (555)

Other operating expenses - (75,155)

Profit/(Loss) before taxation 88,738 (75,091)

Taxation - deferred tax (Note 32) - -

Profit/(Loss) from discontinued operation 88,738 (75,091)

(iii) Analysis of the cash flows of discontinued operations is as follows:

2021 2020

RM’000 RM’000

Operating cash flows (1,893) (14,069)

Investing cash flows 1,815 619

Total cash outflow (78) (13,450)

(iv) Profit/(Loss) before taxation from discontinued operations is stated after charging/(crediting):

2021 2020

RM’000 RM’000

Reversal of impairment of asset held for sale - (1,762)

Impairment of property, plant and equipment - 43,705

(Reversal of impairment)/Impairment of receivables (16) 20

Depreciation of property, plant and equipment - 2,011

Depreciation of right-of-use assets - 2,674

Property, plant and equipment written-off - 27,244

Staff costs 183 307

Gain on disposal of a subsidiary (85,527) -

Inventories written off - 177

Gain on disposal of property, plant and equipment (1,572) (566)

During the financial year ended 31 December 2019, the recoverability of plantation assets which included leasehold land

and bearer plants was determined based on the offer price received from a potential buyer. Following the assessment,

an impairment of RM1,762,000 was made during financial year ended 31 December 2019 upon reclassification of the

asset to Assets Held for Sale from Right-of-Use Assets and Property, Plant and Equipment.