Page 320 - MSM_AIR2021

P. 320

318 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

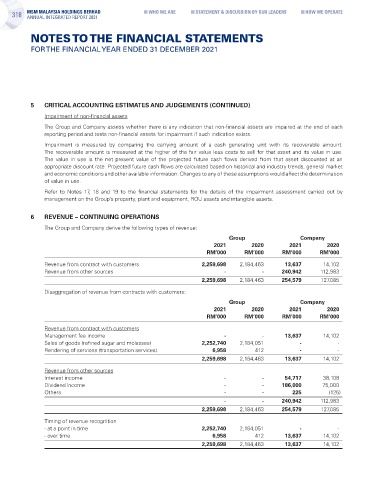

5 CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS (CONTINUED)

Impairment of non-financial assets

The Group and Company assess whether there is any indication that non-financial assets are impaired at the end of each

reporting period and tests non-financial assets for impairment if such indication exists.

Impairment is measured by comparing the carrying amount of a cash generating unit with its recoverable amount.

The recoverable amount is measured at the higher of the fair value less costs to sell for that asset and its value in use.

The value in use is the net present value of the projected future cash flows derived from that asset discounted at an

appropriate discount rate. Projected future cash flows are calculated based on historical and industry trends, general market

and economic conditions and other available information. Changes to any of these assumptions would affect the determination

of value in use.

Refer to Notes 17, 18 and 19 to the financial statements for the details of the impairment assessment carried out by

management on the Group’s property, plant and equipment, ROU assets and intangible assets.

6 REVENUE – CONTINUING OPERATIONS

The Group and Company derive the following types of revenue:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Revenue from contract with customers 2,259,698 2,184,463 13,637 14,102

Revenue from other sources - - 240,942 112,983

2,259,698 2,184,463 254,579 127,085

Disaggregation of revenue from contracts with customers:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Revenue from contract with customers

Management fee income - - 13,637 14,102

Sales of goods (refined sugar and molasses) 2,252,740 2,184,051 - -

Rendering of services (transportation services) 6,958 412 - -

2,259,698 2,184,463 13,637 14,102

Revenue from other sources

Interest income - - 54,717 38,108

Dividend income - - 186,000 75,000

Others - - 225 (125)

- - 240,942 112,983

2,259,698 2,184,463 254,579 127,085

Timing of revenue recognition

- at a point in time 2,252,740 2,184,051 - -

- over time 6,958 412 13,637 14,102

2,259,698 2,184,463 13,637 14,102