Page 312 - MSM_AIR2021

P. 312

310 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

4 FINANCIAL RISK MANAGEMENT (CONTINUED)

(a) Financial risk management policies (continued)

Market risk (continued)

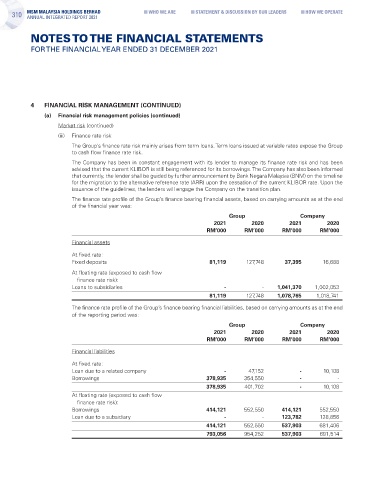

(iii) Finance rate risk

The Group’s finance rate risk mainly arises from term loans. Term loans issued at variable rates expose the Group

to cash flow finance rate risk.

The Company has been in constant engagement with its lender to manage its finance rate risk and has been

advised that the current KLIBOR is still being referenced for its borrowings. The Company has also been informed

that currently, the lender shall be guided by further announcement by Bank Negara Malaysia (BNM) on the timeline

for the migration to the alternative reference rate (ARR) upon the cessation of the current KLIBOR rate. Upon the

issuance of the guidelines, the lenders will engage the Company on the transition plan.

The finance rate profile of the Group’s finance bearing financial assets, based on carrying amounts as at the end

of the financial year was:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Financial assets

At fixed rate:

Fixed deposits 81,119 127,748 37,395 16,688

At floating rate (exposed to cash flow

finance rate risk):

Loans to subsidiaries - - 1,041,370 1,002,053

81,119 127,748 1,078,765 1,018,741

The finance rate profile of the Group’s finance bearing financial liabilities, based on carrying amounts as at the end

of the reporting period was:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Financial liabilities

At fixed rate:

Loan due to a related company - 47,152 - 10,108

Borrowings 378,935 354,550 - -

378,935 401,702 - 10,108

At floating rate (exposed to cash flow

finance rate risk):

Borrowings 414,121 552,550 414,121 552,550

Loan due to a subsidiary - - 123,782 128,856

414,121 552,550 537,903 681,406

793,056 954,252 537,903 691,514