Page 357 - MSM_AIR2021

P. 357

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 355

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

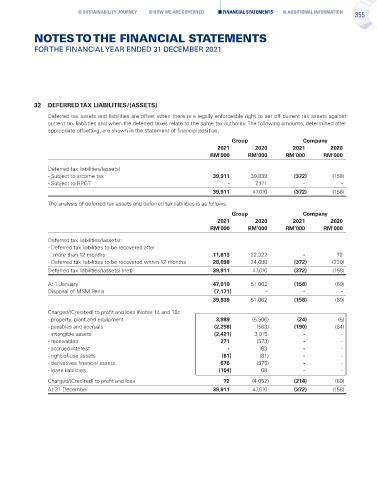

32 DEFERRED TAX LIABILITIES/(ASSETS)

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against

current tax liabilities and when the deferred taxes relate to the same tax authority. The following amounts, determined after

appropriate offsetting, are shown in the statement of financial position:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Deferred tax liabilities/(assets)

- Subject to income tax 39,911 39,839 (372) (158)

- Subject to RPGT - 7,171 - -

39,911 47,010 (372) (158)

The analysis of deferred tax assets and deferred tax liabilities is as follows:

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Deferred tax liabilities/(assets):

- Deferred tax liabilities to be recovered after

more than 12 months 11,813 22,322 - 72

- Deferred tax liabilities to be recovered within 12 months 28,098 24,688 (372) (230)

Deferred tax liabilities/(assets) (net) 39,911 47,010 (372) (158)

At 1 January 47,010 51,062 (158) (69)

Disposal of MSM Perlis (7,171) - - -

39,839 51,062 (158) (69)

Charged/(Credited) to profit and loss (Notes 14 and 16):

- property, plant and equipment 3,989 (5,506) (24) (5)

- payables and accruals (2,258) (563) (190) (84)

- intangible assets (2,421) 3,015 - -

- receivables 271 (573) - -

- accrued interest - 163 - -

- right-of-use assets (81) (81) - -

- derivatives financial assets 676 (575) - -

- lease liabilities (104) 68 - -

Charged/(Credited) to profit and loss 72 (4,052) (214) (89)

At 31 December 39,911 47,010 (372) (158)