Page 361 - MSM_AIR2021

P. 361

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 359

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

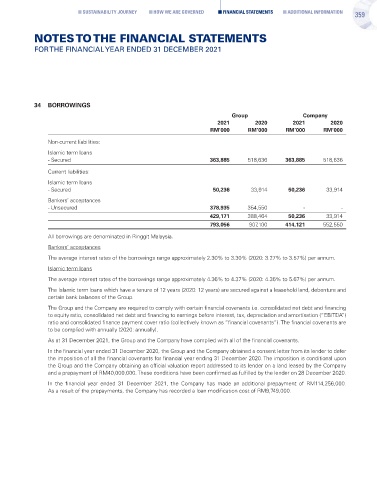

34 BORROWINGS

Group Company

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Non-current liabilities:

Islamic term loans

- Secured 363,885 518,636 363,885 518,636

Current liabilities:

Islamic term loans

- Secured 50,236 33,914 50,236 33,914

Bankers’ acceptances

- Unsecured 378,935 354,550 - -

429,171 388,464 50,236 33,914

793,056 907,100 414,121 552,550

All borrowings are denominated in Ringgit Malaysia.

Bankers’ acceptances

The average interest rates of the borrowings range approximately 2.30% to 3.30% (2020: 3.27% to 3.57%) per annum.

Islamic term loans

The average interest rates of the borrowings range approximately 4.36% to 4.37% (2020: 4.36% to 5.67%) per annum.

The Islamic term loans which have a tenure of 12 years (2020: 12 years) are secured against a leasehold land, debenture and

certain bank balances of the Group.

The Group and the Company are required to comply with certain financial covenants i.e. consolidated net debt and financing

to equity ratio, consolidated net debt and financing to earnings before interest, tax, depreciation and amortisation (“EBITDA”)

ratio and consolidated finance payment cover ratio (collectively known as “financial covenants”). The financial covenants are

to be complied with annually (2020: annually).

As at 31 December 2021, the Group and the Company have complied with all of the financial covenants.

In the financial year ended 31 December 2020, the Group and the Company obtained a consent letter from its lender to defer

the imposition of all the financial covenants for financial year ending 31 December 2020. The imposition is conditional upon

the Group and the Company obtaining an official valuation report addressed to its lender on a land leased by the Company

and a prepayment of RM40,000,000. These conditions have been confirmed as fulfilled by the lender on 28 December 2020.

In the financial year ended 31 December 2021, the Company has made an additional prepayment of RM114,256,000.

As a result of the prepayments, the Company has recorded a loan modification cost of RM9,749,000.