Page 359 - MSM_AIR2021

P. 359

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 357

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

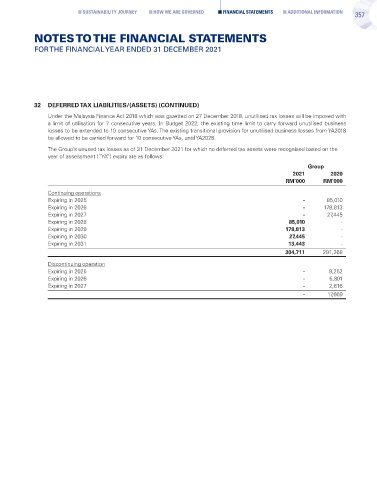

32 DEFERRED TAX LIABILITIES/(ASSETS) (CONTINUED)

Under the Malaysia Finance Act 2018 which was gazetted on 27 December 2018, unutilised tax losses will be imposed with

a limit of utilisation for 7 consecutive years. In Budget 2022, the existing time limit to carry forward unutilised business

losses to be extended to 10 consecutive YAs. The existing transitional provision for unutilised business losses from YA2018

be allowed to be carried forward for 10 consecutive YAs, until YA2028.

The Group’s unused tax losses as of 31 December 2021 for which no deferred tax assets were recognised based on the

year of assessment (“YA”) expiry are as follows:

Group

2021 2020

RM’000 RM’000

Continuing operations

Expiring in 2025 - 85,010

Expiring in 2026 - 178,813

Expiring in 2027 - 27,445

Expiring in 2028 85,010 -

Expiring in 2029 178,813 -

Expiring in 2030 27,445 -

Expiring in 2031 13,443 -

304,711 291,268

Discontinuing operation

Expiring in 2025 - 9,252

Expiring in 2026 - 5,801

Expiring in 2027 - 2,616

- 17,669