Page 328 - MSM_AIR2021

P. 328

326 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

16 PROFIT/(LOSS) FROM DISCONTINUING OPERATION (CONTINUED)

(iv) Profit/(Loss) before taxation from discontinued operations is stated after charging/(crediting): (continued)

During the financial year ended 31 December 2020, the Group had exercised its right to rescind the sales and purchase

agreement previously entered to dispose its plantation assets. Pursuant to this, the related assets were reclassified

from Assets Held for Sale to Right-of-Use Assets and Property, Plant and Equipment and continued to be depreciated.

In the financial year ended 31 December 2020, the Group has performed a valuation exercise on its assets. Pursuant to

the valuation exercise, the Group has reversed an impairment charge of RM1,762,000 recorded previously.

The fair value was within Level 2 of the fair value hierarchy as this was based on comparison of prices for similar assets.

On 29 September 2021, MSM Malaysia Holdings Berhad (“the Company”) completed the disposal of the entire equity

of MSM Perlis Sdn Bhd (“MSMP”), a wholly owned subsidiary of the Company, for a total cash consideration of

RM181,106,000, which resulted in a gain on disposal of RM91,814,000. Further details of the gain on disposal is

reflected in Note 20 to the financial statements.

Of the total gain, RM85,527,000 is shown as gain on disposal from discontinued operations.

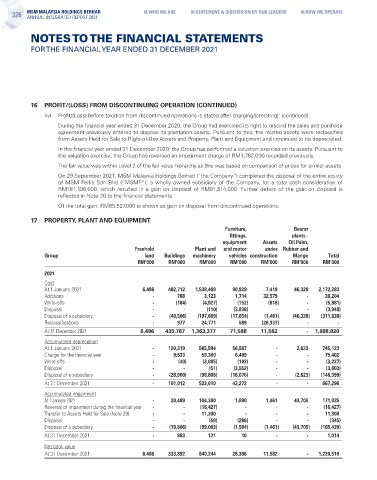

17 PROPERTY, PLANT AND EQUIPMENT

Furniture, Bearer

fittings, plants -

equipment Assets Oil Palm,

Freehold Plant and and motor under Rubber and

Group land Buildings machinery vehicles construction Mango Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2021

Cost

At 1 January 2021 6,486 482,712 1,538,409 90,929 7,419 46,328 2,172,283

Additions - 788 3,123 1,714 32,579 - 38,204

Write-offs - (184) (4,927) (152) (618) - (5,881)

Disposal - - (110) (3,838) - - (3,948)

Disposal of a subsidiary - (48,506) (197,889) (17,654) (1,461) (46,328) (311,838)

Reclassifications - 977 24,771 589 (26,337) - -

At 31 December 2021 6,486 435,787 1,363,377 71,588 11,582 - 1,888,820

Accumulated depreciation

At 1 January 2021 - 120,319 565,594 56,587 - 2,623 745,123

Charge for the financial year - 9,633 59,360 6,409 - - 75,402

Write-offs - (40) (3,085) (102) - - (3,227)

Disposal - - (51) (3,552) - - (3,603)

Disposal of a subsidiary - (28,900) (98,806) (16,070) - (2,623) (146,399)

At 31 December 2021 - 101,012 523,010 43,272 - - 667,296

Accumulated impairment

At 1 January 2021 - 20,489 104,390 1,880 1,461 43,705 171,925

Reversal of impairment during the financial year - - (16,427) - - - (16,427)

Transfer to Assets Held for Sale (Note 29) - - 11,300 - - - 11,300

Disposal - - (59) (286) - - (345)

Disposal of a subsidiary - (19,606) (99,083) (1,584) (1,461) (43,705) (165,439)

At 31 December 2021 - 883 121 10 - - 1,014

Net book value

At 31 December 2021 6,486 333,892 840,244 28,306 11,582 - 1,220,510