Page 332 - MSM_AIR2021

P. 332

330 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

17 PROPERTY, PLANT AND EQUIPMENT (CONTINUED)

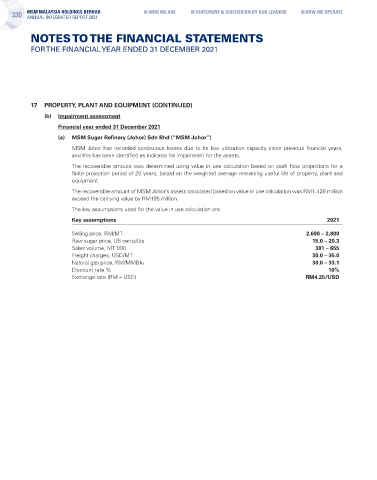

(b) Impairment assessment

Financial year ended 31 December 2021

(a) MSM Sugar Refinery (Johor) Sdn Bhd (“MSM Johor”)

MSM Johor has recorded continuous losses due to its low utilisation capacity since previous financial years,

and this has been identified as indicator for impairment for the assets.

The recoverable amount was determined using value in use calculation based on cash flow projections for a

finite projection period of 20 years, based on the weighted average remaining useful life of property, plant and

equipment.

The recoverable amount of MSM Johor’s assets calculated based on value in use calculation was RM1,428 million

exceed the carrying value by RM195 million.

The key assumptions used for the value in use calculation are:

Key assumptions 2021

Selling price, RM/MT 2,690 – 2,800

Raw sugar price, US cents/lbs 15.0 – 20.3

Sales volume, MT’000 381 – 655

Freight charges, USD/MT 30.0 – 35.0

Natural gas price, RM/MMBtu 30.0 – 33.1

Discount rate % 10%

Exchange rate (RM – USD) RM4.25/USD