Page 76 - MSM_AIR2021

P. 76

74 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

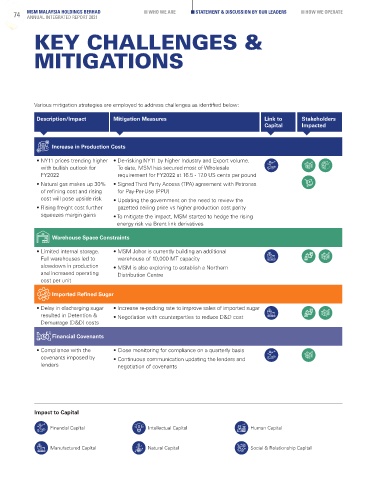

KEY CHALLENGES &

MITIGATIONS

Various mitigation strategies are employed to address challenges as identified below:

Description/Impact Mitigation Measures Link to Stakeholders

Capital Impacted

Increase in Production Costs

• NY11 prices trending higher • De-risking NY11 by higher Industry and Export volume.

with bullish outlook for To date, MSM has secured most of Wholesale

FY2022 requirement for FY2022 at 16.5 - 17.0 US cents per pound

• Natural gas makes up 30% • Signed Third Party Access (TPA) agreement with Petronas

of refining cost and rising for Pay-Per-Use (PPU)

cost will pose upside risk • Updating the government on the need to review the

• Rising freight cost further gazetted ceiling price vs higher production cost parity

squeezes margin gains • To mitigate the impact, MSM started to hedge the rising

energy risk via Brent link derivatives

Warehouse Space Constraints

• Limited internal storage. • MSM Johor is currently building an additional

Full warehouses led to warehouse of 10,000 MT capacity

slowdown in production • MSM is also exploring to establish a Northern

and increased operating Distribution Centre

cost per unit

Imported Refined Sugar

• Delay in discharging sugar • Increase re-packing rate to improve sales of imported sugar

resulted in Detention & • Negotiation with counterparties to reduce D&D cost

Demurrage (D&D) costs

Financial Covenants

• Compliance with the • Close monitoring for compliance on a quarterly basis

covenants imposed by • Continuous communication updating the lenders and

lenders negotiation of covenants

Impact to Capital

Financial Capital Intellectual Capital Human Capital

Manufactured Capital Natural Capital Social & Relationship Capital