Page 72 - MSM_AIR2021

P. 72

70 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

CORPORATE STRATEGY AND

BUSINESS PLAN REVIEW

MSM is currently guided by a 3-year Strategic Plan through which

“Turnaround Through Asset Optimisation” was initiated in FY2021.

In FY2021 the focus of Turnaround This was supported by the Business Plan 2021 (BP21) and continues to

was primarily on the business front be supported by the Business Plan 2021-2023 (BP23) going forward.

as we worked to maximise our We also worked on ramping up our ESG journey during the year,

as a step towards meeting FTSE4Good Index standards and ensuring

capabilities while seeking ways to improved data gathering across the Group.

expand our market demand and

Sustainability initiatives and performance are detailed in the

enhance our liquidity. Sustainability Report on page 118.

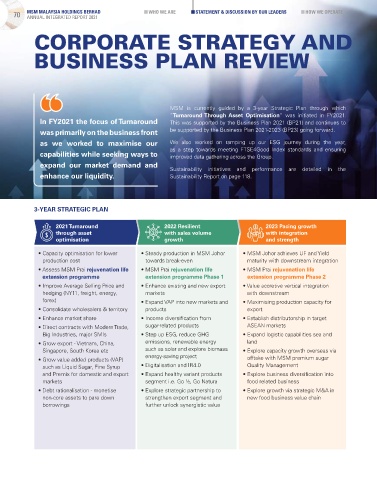

3-YEAR STRATEGIC PLAN

2021 Turnaround 2022 Resilient 2023 Pacing growth

through asset with sales volume with integration

optimisation growth and strength

• Capacity optimisation for lower • Steady production in MSM Johor • MSM Johor achieves UF and Yield

production cost towards break-even maturity with downstream integration

• Assess MSM Prai rejuvenation life • MSM Prai rejuvenation life • MSM Prai rejuvenation life

extension programme extension programme Phase 1 extension programme Phase 2

• Improve Average Selling Price and • Enhance existing and new export • Value accretive vertical integration

hedging (NY11, freight, energy, markets with downstream

forex) • Expand VAP into new markets and • Maximising production capacity for

• Consolidate wholesalers & territory products export

• Enhance market share • Income diversification from • Establish distributorship in target

• Direct contracts with Modern Trade, sugar-related products ASEAN markets

Big Industries, major SMIs • Step up ESG, reduce GHG • Expand logistic capabilities sea and

• Grow export - Vietnam, China, emissions, renewable energy land

Singapore, South Korea etc such as solar and explore biomass • Explore capacity growth overseas via

energy-saving project

• Grow value added products (VAP) offtake with MSM premium sugar

such as Liquid Sugar, Fine Syrup • Digitalisation and IR4.0 Quality Management

and Premix for domestic and export • Expand healthy variant products • Explore business diversification into

markets segment i.e. Go ½, Go Natura food related business

• Debt rationalisation - monetise • Explore strategic partnership to • Explore growth via strategic M&A in

non-core assets to pare down strengthen export segment and new food business value chain

borrowings further unlock synergistic value