Page 334 - MSM_AIR2021

P. 334

332 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

17 PROPERTY, PLANT AND EQUIPMENT (CONTINUED)

(b) Impairment assessment (continued)

Financial year ended 31 December 2021 (continued)

(c) MSM Perlis Sdn Bhd (“MSM Perlis”) (continued)

After considering the condition of the bearer plants as a result of the cessation of the plantation operations

and a fire during the financial year ended 31 December 2020 which resulted in a write-off of RM27,244,000,

an impairment assessment was performed on bearer plants. The assessment indicated the recoverable amount

of the bearer plant assets as nil. Accordingly, an impairment of RM43,705,000 was recorded in the financial year

ended 31 December 2020.

During the current financial year, the Group carried out an assessment on the recoverable amount of certain plant

and machinery assets previously impaired in financial year ended 31 December 2019. Following the assessment,

the Group has reversed a total impairment of RM5,127,000 as a result of a change in the recoverable amount of

these assets.

During the financial year ended 31 December 2020, leasehold plantation land and leasehold factory land located

at Chuping, Perlis were transferred to Assets Held for Sale following offer received from potential buyer.

On 29 September 2021, MSM Malaysia Holdings Berhad (“the Company”) completed the disposal of the entire

equity of MSM Perlis Sdn Bhd (“MSMP”), a wholly owned subsidiary of MSMH, for a total cash consideration

of RM181,106,000. The assets and liabilities of MSMP were deconsolidated upon completion of the disposal.

The effects of the disposal is reflected in Note 20 to the financial statements.

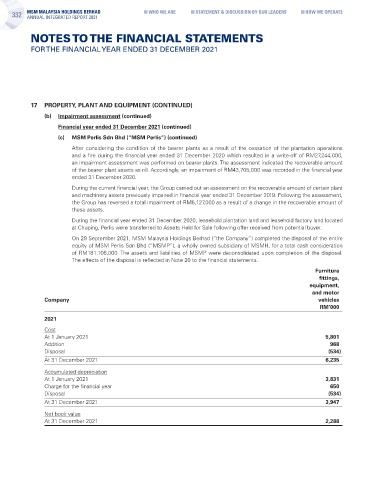

Furniture

fittings,

equipment,

and motor

Company vehicles

RM’000

2021

Cost

At 1 January 2021 5,801

Addition 968

Disposal (534)

At 31 December 2021 6,235

Accumulated depreciation

At 1 January 2021 3,831

Charge for the financial year 650

Disposal (534)

At 31 December 2021 3,947

Net book value

At 31 December 2021 2,288