Page 258 - MSM_AIR2021

P. 258

256 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

STATEMENT ON

RISK MANAGEMENT AND

INTERNAL CONTROL

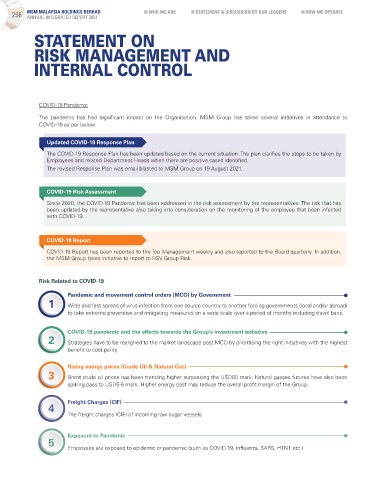

COVID-19 Pandemic

The pandemic has had significant impact on the Organisation. MSM Group has taken several initiatives in attendance to

COVID-19 as per below:

Updated COVID-19 Response Plan

The COVID-19 Response Plan has been updated based on the current situation. The plan clarifies the steps to be taken by

Employees and related Department Heads when there are positive cases identified.

The revised Response Plan was email blasted to MSM Group on 19 August 2021.

COVID-19 Risk Assessment

Since 2020, the COVID-19 Pandemic has been addressed in the risk assessment by the representatives. The risk that has

been updated by the representative also taking into consideration on the monitoring of the employee that been infected

with COVID-19.

COVID-19 Report

COVID-19 Report has been reported to the Top Management weekly and also reported to the Board quarterly. In addition,

the MSM Group takes initiative to report to FGV Group Risk.

Risk Related to COVID-19

Pandemic and movement control orders (MCO) by Government

1 Wide and fast spread of virus infection from one source country to another forcing governments (local and/or abroad)

to take extreme preventive and mitigating measures on a wide scale over a period of months including travel bans.

COVID-19 pandemic and the effects towards the Group’s investment initiative

2 Strategies have to be realigned to the market landscape post MCO by prioritising the right initiatives with the highest

benefit to cost parity.

Rising energy prices (Crude Oil & Natural Gas)

3 Brent crude oil prices has been trending higher surpassing the USD80 mark. Natural gasses futures have also been

spiking pass to USD5-6 mark. Higher energy cost may reduce the overall profit margin of the Group.

Freight Charges (CIF)

4

The freight charges (CIF) of incoming raw sugar vessels.

Exposure to Pandemic

5

Employees are exposed to epidemic or pandemic (such as COVID-19, influenza, SARS, H1N1 etc.)