Page 370 - MSM_AIR2021

P. 370

368 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

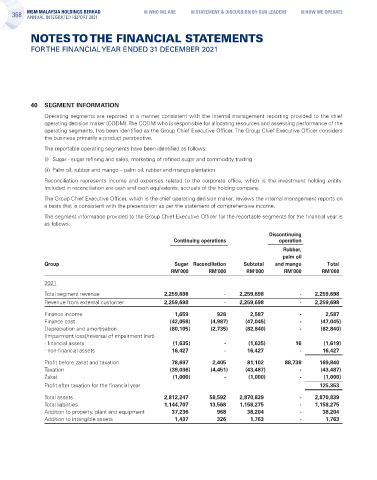

40 SEGMENT INFORMATION

Operating segments are reported in a manner consistent with the internal management reporting provided to the chief

operating decision maker (CODM). The CODM who is responsible for allocating resources and assessing performance of the

operating segments, has been identified as the Group Chief Executive Officer. The Group Chief Executive Officer considers

the business primarily a product perspective.

The reportable operating segments have been identified as follows:

(i) Sugar - sugar refining and sales, marketing of refined sugar and commodity trading

(ii) Palm oil, rubber and mango – palm oil, rubber and mango plantation

Reconciliation represents income and expenses related to the corporate office, which is the investment holding entity.

Included in reconciliation are cash and cash equivalents, accruals of the holding company.

The Group Chief Executive Officer, which is the chief operating decision maker, reviews the internal management reports on

a basis that is consistent with the presentation as per the statement of comprehensive income.

The segment information provided to the Group Chief Executive Officer for the reportable segments for the financial year is

as follows:

Discontinuing

Continuing operations operation

Rubber,

palm oil

Group Sugar Reconciliation Subtotal and mango Total

RM’000 RM’000 RM’000 RM’000 RM’000

2021

Total segment revenue 2,259,698 - 2,259,698 - 2,259,698

Revenue from external customer 2,259,698 - 2,259,698 - 2,259,698

Finance income 1,659 928 2,587 - 2,587

Finance cost (42,058) (4,987) (47,045) - (47,045)

Depreciation and amortisation (80,105) (2,735) (82,840) - (82,840)

(Impairment loss)/reversal of impairment (net)

- financial assets (1,635) - (1,635) 16 (1,619)

- non-financial assets 16,427 - 16,427 - 16,427

Profit before zakat and taxation 78,697 2,405 81,102 88,738 169,840

Taxation (39,036) (4,451) (43,487) - (43,487)

Zakat (1,000) - (1,000) - (1,000)

Profit after taxation for the financial year 125,353

Total assets 2,812,247 58,592 2,870,839 - 2,870,839

Total liabilities 1,144,707 13,568 1,158,275 - 1,158,275

Addition to property, plant and equipment 37,236 968 38,204 - 38,204

Addition to intangible assets 1,437 326 1,763 - 1,763