Page 369 - MSM_AIR2021

P. 369

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 367

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

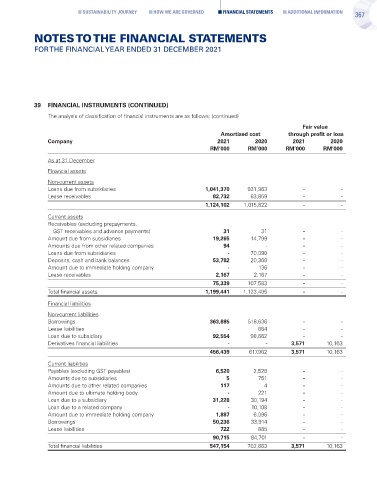

39 FINANCIAL INSTRUMENTS (CONTINUED)

The analysis of classification of financial instruments are as follows: (continued)

Fair value

Amortised cost through profit or loss

Company 2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

As at 31 December

Financial assets

Non-current assets

Loans due from subsidiaries 1,041,370 931,963 - -

Lease receivables 82,732 83,859 - -

1,124,102 1,015,822 - -

Current assets

Receivables (excluding prepayments,

GST receivables and advance payments) 31 31 - -

Amount due from subsidiaries 19,265 14,799 - -

Amounts due from other related companies 94 - - -

Loans due from subsidiaries - 70,090 - -

Deposits, cash and bank balances 53,782 20,360 - -

Amount due to immediate holding company - 136 - -

Lease receivables 2,167 2,167 - -

75,339 107,583 - -

Total financial assets 1,199,441 1,123,405 - -

Financial liabilities

Non-current liabilities

Borrowings 363,885 518,636 - -

Lease liabilities - 664 - -

Loan due to subsidiary 92,554 98,662 - -

Derivatives financial liabilities - - 3,571 10,163

456,439 617,962 3,571 10,163

Current liabilities

Payables (excluding GST payables) 6,520 2,528 - -

Amounts due to subsidiaries 5 751 - -

Amounts due to other related companies 117 4 - -

Amount due to ultimate holding body - 221 - -

Loan due to a subsidiary 31,228 30,194 - -

Loan due to a related company - 10,108 - -

Amount due to immediate holding company 1,887 6,096 - -

Borrowings 50,236 33,914 - -

Lease liabilities 722 885 - -

90,715 84,701 - -

Total financial liabilities 547,154 702,663 3,571 10,163