Page 286 - MSM_AIR2021

P. 286

284 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

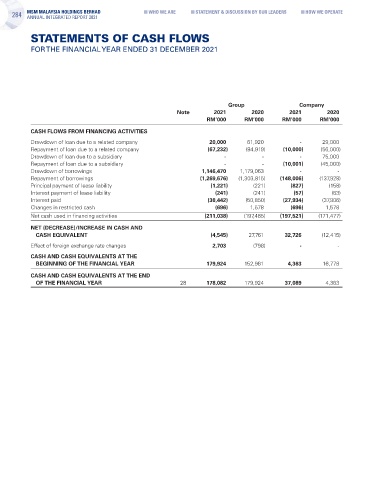

STATEMENTS OF CASH FLOWS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

Group Company

Note 2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

CASH FLOWS FROM FINANCING ACTIVITIES

Drawdown of loan due to a related company 20,000 61,920 - 29,000

Repayment of loan due to a related company (67,232) (84,919) (10,000) (56,000)

Drawdown of loan due to a subsidiary - - - 75,000

Repayment of loan due to a subsidiary - - (10,001) (45,000)

Drawdown of borrowings 1,146,470 1,179,063 - -

Repayment of borrowings (1,269,676) (1,303,815) (148,006) (137,928)

Principal payment of lease liability (1,221) (221) (827) (158)

Interest payment of lease liability (241) (241) (57) (63)

Interest paid (38,442) (50,850) (27,934) (37,906)

Changes in restricted cash (696) 1,578 (696) 1,578

Net cash used in financing activities (211,038) (197,485) (197,521) (171,477)

NET (DECREASE)/INCREASE IN CASH AND

CASH EQUIVALENT (4,545) 27,761 32,726 (12,415)

Effect of foreign exchange rate changes 2,703 (798) - -

CASH AND CASH EQUIVALENTS AT THE

BEGINNING OF THE FINANCIAL YEAR 179,924 152,961 4,363 16,778

CASH AND CASH EQUIVALENTS AT THE END

OF THE FINANCIAL YEAR 28 178,082 179,924 37,089 4,363