Page 284 - MSM_AIR2021

P. 284

282 MSM MALAYSIA HOLDINGS BERHAD WHO WE ARE STATEMENT & DISCUSSION BY OUR LEADERS HOW WE OPERATE

ANNUAL INTEGRATED REPORT 2021

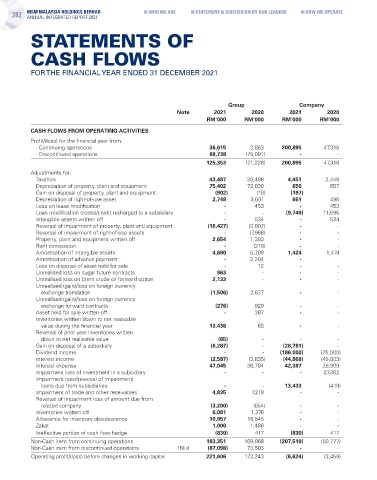

STATEMENTS OF

CASH FLOWS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2021

Group Company

Note 2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

CASH FLOWS FROM OPERATING ACTIVITIES

Profit/(loss) for the financial year from:

- Continuing operations 36,615 3,863 200,895 47,318

- Discontinued operations 88,738 (75,091) - -

125,353 (71,228) 200,895 47,318

Adjustments for:

Taxation 43,487 30,498 4,451 2,448

Depreciation of property, plant and equipment 75,402 72,830 650 657

Gain on disposal of property, plant and equipment (902) (18) (197) -

Depreciation of right-of-use asset 2,748 3,001 661 496

Loss on lease modification - 453 - 453

Loan modification (costs)/credit recharged to a subsidiary - - (9,749) 11,695

Intangible assets written off - 534 - 534

Reversal of impairment of property, plant and equipment (16,427) (3,807) - -

Reversal of impairment of right-of-use assets - (7,968) - -

Property, plant and equipment written off 2,654 1,393 - -

Rent concession - (219) - -

Amortisation of intangible assets 4,690 5,709 1,424 1,474

Amortisation of advance payment - 2,204 -

Loss on disposal of asset held for sale - 12 - -

Unrealised loss on sugar future contracts 963 - - -

Unrealised loss on brent crude oil forward option 2,133 - - -

Unrealised (gain)/loss on foreign currency

exchange translation (1,506) 2,627 - -

Unrealised (gain)/loss on foreign currency

exchange forward contracts (276) 929 - -

Asset held for sale written-off - 387 - -

Inventories written down to net realisable

value during the financial year 13,436 65 - -

Reversal of prior year inventories written

down to net realisable value (65) - - -

Gain on disposal of a subsidiary (6,287) - (28,781) -

Dividend income - - (186,000) (75,000)

Interest income (2,587) (3,835) (44,968) (49,803)

Interest expense 47,045 36,784 42,387 28,909

Impairment loss of investment in a subsidiary - - - 27,362

Impairment loss/(reversal of impairment)

loans due from subsidiaries - - 13,433 (419)

Impairment of trade and other receivables 4,835 7,219 - -

Reversal of impairment loss of amount due from

related company (3,200) (654) - -

Inventories written off 6,081 1,376 - -

Allowance for inventory obsolescence 10,957 18,545 - -

Zakat 1,000 1,486 - -

Ineffective portion of cash flow hedge (830) 417 (830) 417

Non-Cash item from continuing operations 183,351 169,968 (207,519) (50,777)

Non-Cash item from discontinued operations 16(iii) (87,098) 73,503 - -

Operating profit/(loss) before changes in working capital 221,606 172,243 (6,624) (3,459)