Page 249 - MSM_AIR2021

P. 249

SUSTAINABILITY JOURNEY HOW WE ARE GOVERNED FINANCIAL STATEMENTS ADDITIONAL INFORMATION 247

ADDITIONAL COMPLIANCE

INFORMATION

In compliance with the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the following information is

provided:

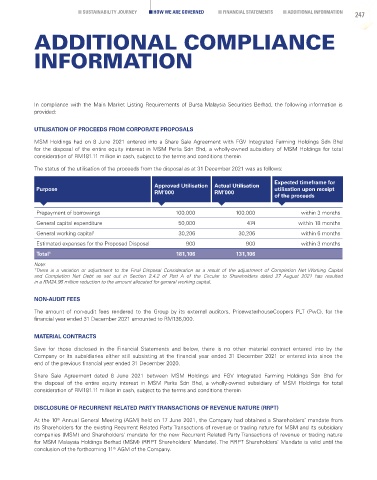

UTILISATION OF PROCEEDS FROM CORPORATE PROPOSALS

MSM Holdings had on 8 June 2021 entered into a Share Sale Agreement with FGV Integrated Farming Holdings Sdn Bhd

for the disposal of the entire equity interest in MSM Perlis Sdn Bhd, a wholly-owned subsidiary of MSM Holdings for total

consideration of RM181.11 million in cash, subject to the terms and conditions therein.

The status of the utilisation of the proceeds from the disposal as at 31 December 2021 was as follows:

Expected timeframe for

Approved Utilisation Actual Utilisation

Purpose utilisation upon receipt

RM’000 RM’000

of the proceeds

Prepayment of borrowings 100,000 100,000 within 3 months

General capital expenditure 50,000 474 within 18 months

General working capital 1 30,206 30,206 within 6 months

Estimated expenses for the Proposed Disposal 900 900 within 3 months

Total 1 181,106 131,106

Note:

1 There is a variation or adjustment to the Final Disposal Consideration as a result of the adjustment of Completion Net Working Capital

and Completion Net Debt as set out in Section 2.4.2 of Part A of the Circular to Shareholders dated 27 August 2021 has resulted

in a RM24.96 million reduction to the amount allocated for general working capital.

NON-AUDIT FEES

The amount of non-audit fees rendered to the Group by its external auditors, PricewaterhouseCoopers PLT (PwC), for the

financial year ended 31 December 2021 amounted to RM136,000.

MATERIAL CONTRACTS

Save for those disclosed in the Financial Statements and below, there is no other material contract entered into by the

Company or its subsidiaries either still subsisting at the financial year ended 31 December 2021 or entered into since the

end of the previous financial year ended 31 December 2020.

Share Sale Agreement dated 8 June 2021 between MSM Holdings and FGV Integrated Farming Holdings Sdn Bhd for

the disposal of the entire equity interest in MSM Perlis Sdn Bhd, a wholly-owned subsidiary of MSM Holdings for total

consideration of RM181.11 million in cash, subject to the terms and conditions therein.

DISCLOSURE OF RECURRENT RELATED PARTY TRANSACTIONS OF REVENUE NATURE (RRPT)

At the 10 Annual General Meeting (AGM) held on 17 June 2021, the Company had obtained a Shareholders’ mandate from

th

its Shareholders for the existing Recurrent Related Party Transactions of revenue or trading nature for MSM and its subsidiary

companies (MSM) and Shareholders’ mandate for the new Recurrent Related Party Transactions of revenue or trading nature

for MSM Malaysia Holdings Berhad (MSM) (RRPT Shareholders’ Mandate). The RRPT Shareholders’ Mandate is valid until the

conclusion of the forthcoming 11 AGM of the Company.

th